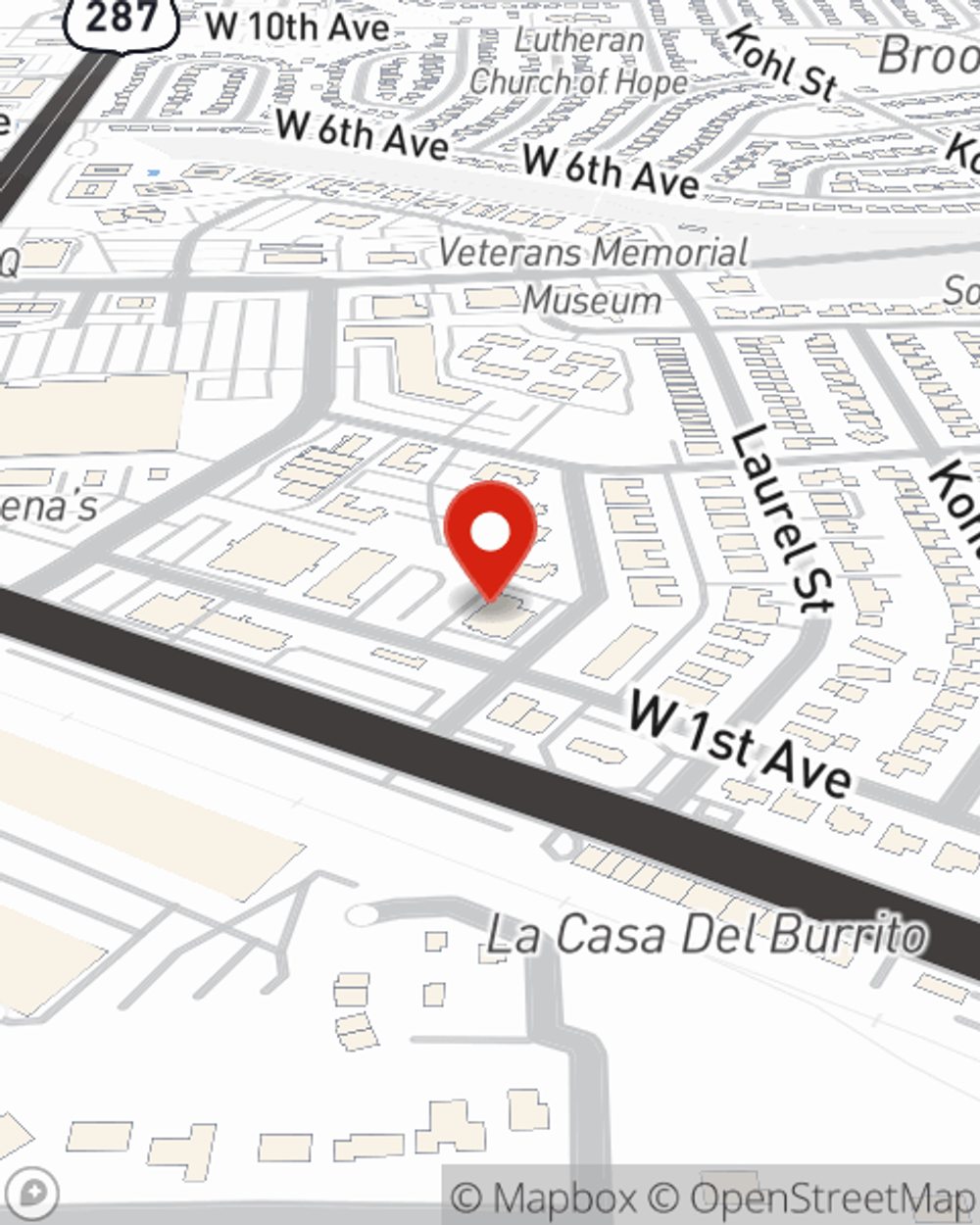

Business Insurance in and around Broomfield

One of Broomfield’s top choices for small business insurance.

Helping insure small businesses since 1935

- Broomfield, Colorado

- Westminster

- Boulder, Colorado

- Erie, Colorado

- Lafayette, Colorado

- Denver, Colorado

- Thornton, Colorado

- Brighton, Colorado

- Silverthorne

- Breckenridge

- Vail

- Commerce City

- Louisville

- Superior

Insure The Business You've Built.

When experiencing the highs and lows of small business ownership, let State Farm take one thing off your plate and help provide terrific insurance for your business. Your policy can include options such as business continuity plans, a surety or fidelity bond, and extra liability coverage.

One of Broomfield’s top choices for small business insurance.

Helping insure small businesses since 1935

Protect Your Future With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Becky Ledbetter for a policy that protects your business. Your coverage can include everything from extra liability coverage or business continuity plans to group life insurance if there are 5 or more employees or key employee insurance.

Call Becky Ledbetter today, and let's get down to business.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Becky Ledbetter

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.